Introduction

Japan’s economy, once the envy of the world, has faced significant challenges since the early 1990s, leading to what is commonly referred to as the “Lost Decade” and beyond. The collapse of Japan’s economy was not a singular event but rather a culmination of various factors that interacted over time. This article aims to explore the causes of Japan’s economic collapse in detail, examining historical context, key economic policies, demographic changes, and external influences.

Historical Context

Post-War Economic Miracle

Following World War II, Japan experienced rapid economic growth, often referred to as the “Japanese Economic Miracle.” This period, from the 1950s to the late 1980s, was characterized by:

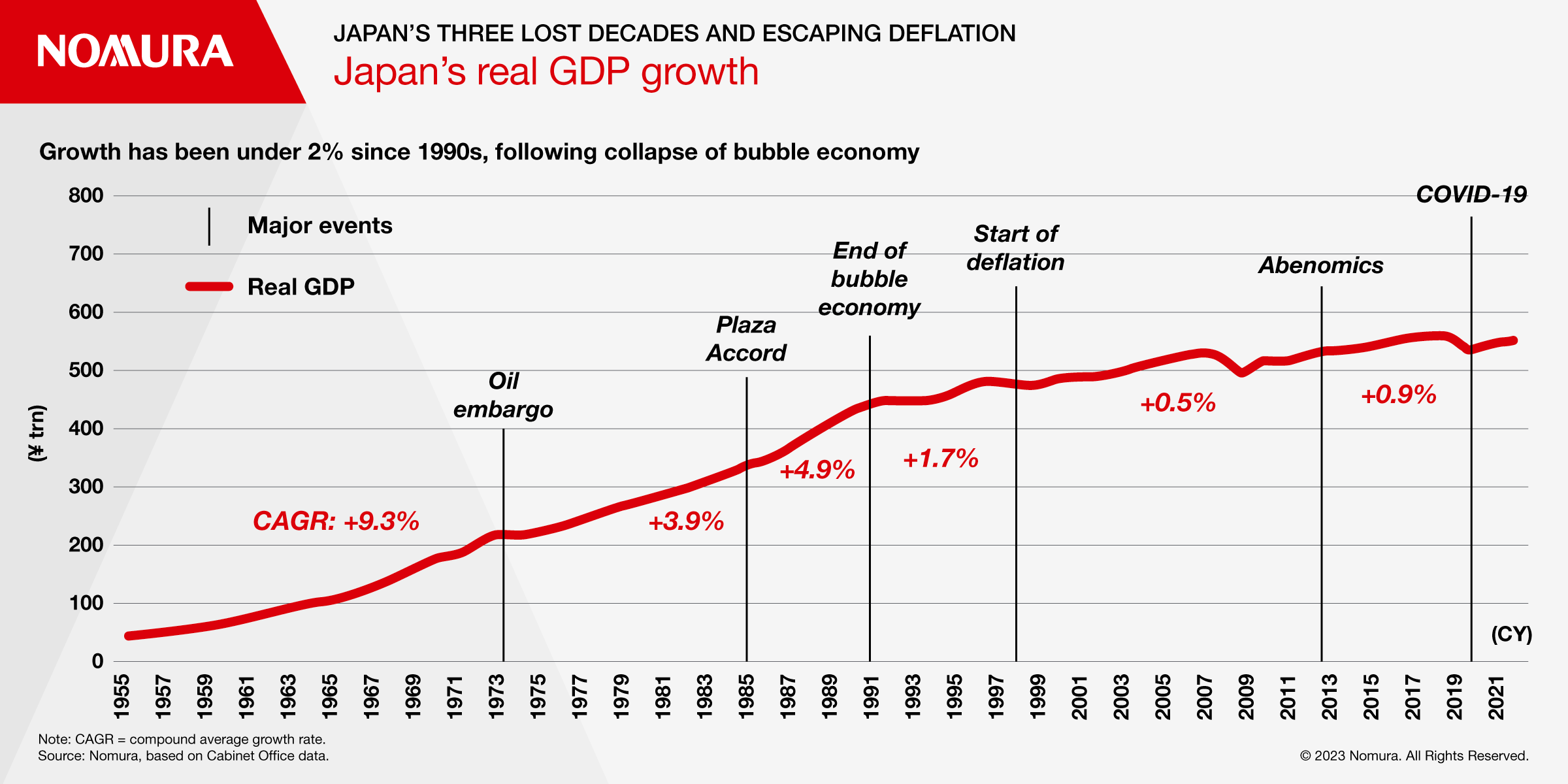

- High Growth Rates: Annual GDP growth rates often exceeded 10%.

- Industrial Expansion: Significant investments in manufacturing and technology.

- Export-Led Growth: A focus on exporting goods, particularly in electronics and automobiles.

However, this growth was built on a fragile foundation that would later contribute to its downfall.

The Bubble Economy

In the late 1980s, Japan entered a period of excessive speculation in real estate and stock markets, leading to an asset price bubble. Key characteristics included:

- Rapid Credit Expansion: Banks lent excessively due to low interest rates and government policies encouraging borrowing.

- Overvaluation of Assets: Real estate and stock prices soared beyond sustainable levels.

This speculative environment set the stage for a dramatic collapse.

Causes of Economic Collapse

1. The Burst of the Asset Bubble

The most significant event leading to Japan’s economic decline was the bursting of its asset bubble in the early 1990s:

- Stock Market Crash: In December 1989, the Nikkei stock index peaked at nearly 39,000 points but plummeted by about 60% within two years.

- Real Estate Collapse: Land prices began their descent shortly after stock prices fell, leading to widespread insolvencies among businesses heavily invested in these assets.

The aftermath left banks with significant non-performing loans (NPLs), crippling their ability to lend and thereby stifling economic growth.

2. Policy Mismanagement

A. Monetary Policy Failures

The Bank of Japan’s monetary policy decisions played a critical role in both inflating the bubble and failing to mitigate its aftermath:

- Interest Rate Hikes: To combat inflationary pressures from the bubble economy, the Bank of Japan raised interest rates sharply in late 1989. This action contributed directly to the bubble’s collapse.

- Delayed Response: After the crash, the central bank maintained low interest rates for too long without addressing underlying issues within the banking sector.

B. Fiscal Policy Issues

Japan’s fiscal policies were also inadequate during this period:

- Consumption Tax Increase: The introduction of a consumption tax in 1997 stifled consumer spending at a time when recovery was needed.

- Public Works Spending: Heavy reliance on public works projects with low multiplier effects failed to stimulate sustainable economic growth.

3. Banking Sector Problems

The banking sector’s inability to manage bad debts effectively compounded Japan’s economic troubles:

- Zombie Banks: Many banks became “zombie banks,” sustaining unprofitable firms with bailouts rather than allowing market corrections.

- Slow NPL Resolution: The prolonged failure to resolve non-performing loans hampered financial institutions’ ability to lend and invest in productive ventures.

4. Demographic Challenges

Japan’s demographic trends have posed significant challenges for its economy:

- Aging Population: With one of the highest life expectancies globally, Japan faces rising healthcare costs and a shrinking workforce.

- Low Birth Rates: The declining birth rate exacerbates labor shortages and increases dependency ratios.

These demographic shifts have led to reduced consumer demand and increased pressure on social welfare systems.

5. Global Economic Factors

External factors also played a role in Japan’s economic struggles:

- Asian Financial Crisis (1997-1998): This crisis had ripple effects on Japan’s economy, leading to decreased exports and investment.

- Yen Appreciation: A sustained appreciation of the yen made Japanese exports more expensive and less competitive internationally.

6. Structural Economic Issues

Japan’s economy suffers from several structural impediments that hinder growth:

- Rigid Labor Market: Employment practices have made it difficult for companies to adapt quickly to changing market conditions.

- Low Productivity Growth: Stagnation in productivity growth has limited overall economic expansion.

Economic Indicators

The following table summarizes key economic indicators relevant to Japan’s economic situation during this period:

| Indicator | Value (1990) | Value (2000) |

|---|---|---|

| Nominal GDP | $3.3 trillion | $4.3 trillion |

| Real GDP Growth Rate | 5.5% | 2.8% |

| Unemployment Rate | 2.1% | 4.7% |

| Non-performing Loans (NPLs) | Unknown | Estimated at 8% |

| Public Debt as % of GDP | 60% | 130% |

For more detailed statistics and insights on Japan’s economy during this period, refer to this source.

Long-Term Consequences

The consequences of Japan’s economic collapse have been profound and far-reaching:

1. Persistent Economic Stagnation

Japan has struggled with low growth rates for decades following its economic decline:

- Average real GDP growth has hovered around 1% annually since the early 1990s.

- The term “Lost Decade” has evolved into discussions about “Lost Decades,” reflecting ongoing stagnation.

2. Socioeconomic Impacts

The economic downturn has had significant societal implications:

- Increased unemployment rates have led to greater social inequality.

- An aging population coupled with stagnant wages has resulted in increased poverty among older citizens.

3. Political Ramifications

Political responses to economic challenges have often been inadequate or ineffective:

- Frequent changes in leadership without consistent policy direction have hindered effective governance.

- Public disillusionment with political institutions has grown as citizens grapple with ongoing economic difficulties.

Future Outlook

While Japan continues to face significant challenges, there are potential pathways for recovery:

1. Economic Reforms

Implementing structural reforms could help revitalize Japan’s economy:

- Labor market reforms aimed at increasing flexibility could enhance productivity.

- Encouraging innovation through investment in technology and education may spur new growth sectors.

2. Demographic Strategies

Addressing demographic challenges will be crucial for long-term sustainability:

- Policies that promote higher birth rates or attract skilled immigrants could help mitigate labor shortages.

- Enhancing support for elderly citizens can alleviate some pressures on social welfare systems.

3. International Trade Opportunities

Japan can leverage its strengths in technology and manufacturing by expanding trade partnerships:

- Diversifying export markets can reduce dependency on traditional partners.

- Engaging more actively in regional trade agreements may enhance competitiveness.

Conclusion

Japan’s economic collapse was not caused by a single event but rather resulted from a combination of factors that interacted over time. The burst of the asset bubble, policy mismanagement, banking sector failures, demographic challenges, global economic influences, and structural issues all contributed significantly to this downturn. Understanding these causes is essential for addressing current challenges and paving the way for future recovery.

FAQ Section

1. What triggered Japan’s economic collapse?

The collapse was primarily triggered by the bursting of an asset bubble in real estate and stock markets during the early 1990s.

2. How did policy mismanagement contribute?

Policy mismanagement included poor monetary policy decisions by the Bank of Japan and inadequate fiscal responses that failed to stimulate recovery effectively.

3. What role did demographics play?

An aging population combined with low birth rates led to a shrinking workforce and increased dependency ratios, straining social services and reducing consumer demand.

4. What are “zombie banks”?

Zombie banks are financial institutions that continue operating despite being insolvent due to government bailouts that prevent them from addressing their bad debts effectively.

5. How did global factors impact Japan’s economy?

Global factors such as the Asian financial crisis and yen appreciation diminished export competitiveness while contributing to overall economic instability.

6. What are some long-term consequences of this collapse?

Long-term consequences include persistent low growth rates, increased social inequality, rising poverty among older citizens, and political disillusionment with governance.

7. Can Japan recover from these challenges?

While recovery is challenging, potential strategies include implementing structural reforms, addressing demographic issues through immigration or family support policies, and enhancing international trade relations.This comprehensive overview provides insights into why Japan’s economy collapsed while exploring potential avenues for future recovery amidst ongoing challenges.